Atome is a popular Buy Now, Pay Later (BNPL) service in the Philippines. It issues a physical and virtual Mastercard with up to ₱200,000 credit. Shoppers use it to pay later for online purchases, retail goods, travel bookings, and other expenses.

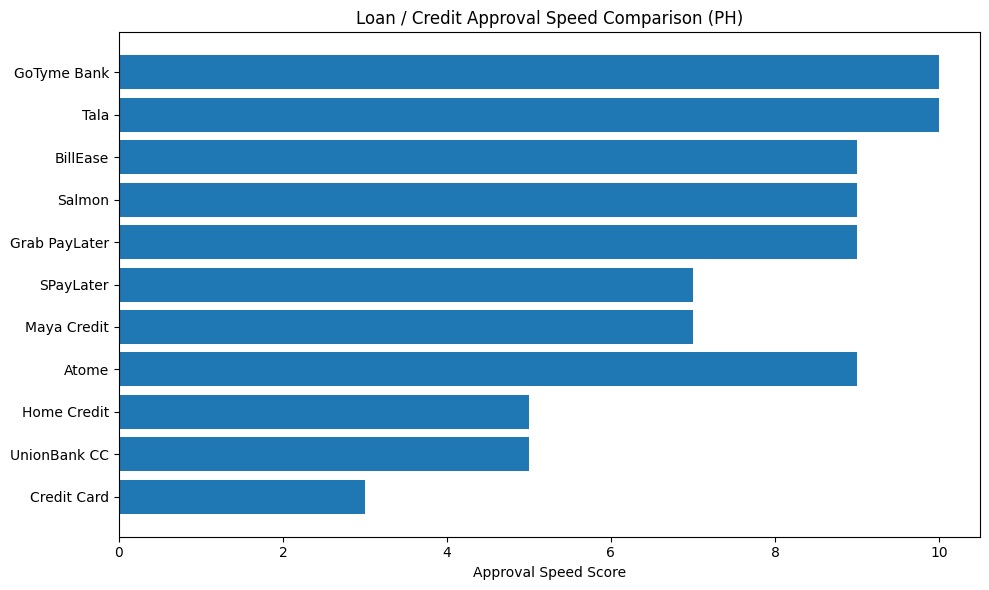

Filipinos compare Atome with other payment and credit options to find the most flexible or cost-effective way to pay for big and everyday expenses. Each option, whether a BNPL app, a credit card, a debit account, or a loan, has different terms, including fees, interest rates, credit limits, and approval requirements.

Atome’s typical use cases include paying in installments for purchases on Lazada, Shopee, or in-store using the Atome Card. It offers 0% interest for a certain period (approximately 40 days) and installment plans of up to 6 months.

Meanwhile, other services like GoTyme Bank (a digital debit account), BillEase (another BNPL app), Salmon (a micro-credit card), UnionBank credit cards, Home Credit (retail installment loans), Shopee SPayLater, Maya Credit (e-wallet credit), Grab PayLater, and Tala (loan app) all compete as payment options. Comparing them helps decide which one fits your shopping habits, repayment ability, and financial goals.

Below is a quick comparison of Atome and other payment options in the Philippines.

| Monthly interest on the borrowed amount | Type | Approval Speed | Interest / Fees | Best For |

|---|---|---|---|---|

| Atome | BNPL card & app | Very fast (minutes) | 0% interest (up to ~40 days); fees on longer terms | Frequent online/offline shoppers, travelers |

| GoTyme Bank | Digital bank account | Instant (minutes) | No credit interest (debit); low fees; rewards | Savers, reward-seekers, no-debt users |

| BillEase | BNPL app | Fast (minutes) | Monthly interest on loans; 0% promos available | E-commerce buyers, no credit card |

| Salmon | BNPL credit line | Fast (minutes) | Interest-free if fully paid monthly; fees if not | Small purchases, credit newbies |

| Credit Card | Traditional credit | Slow (days) | Monthly interest on unpaid balance | Large purchases, credit building |

| Home Credit | Retail installment | Moderate (same-day) | Higher interest on installments | Appliance & gadget shoppers, store buyers |

| SPayLater | BNPL app (Shopee) | Fast (minutes) | Monthly interest on installment plans | Shopee/Sea ecosystem shoppers |

| UnionBank CC | Bank credit card | Slow (days) | Monthly interest on unpaid balance | UnionBank customers, perks seekers |

| Tala | Personal loan app | Instant (minutes) | High interest on cash loans | Emergency cash needs, short-term funds |

| Maya Credit | E-wallet credit line | Fast (minutes) | Monthly interest on borrowed amount | Maya e-wallet users, bills & reloads |

| Grab PayLater | BNPL app (Grab) | Fast (minutes) | Monthly interest on installment plans | Grab services & everyday purchases |

Introduction

Filipinos often shop and pay flexibly through modern finance apps. Atome is one such Buy Now, Pay Later provider that’s widely used in the Philippines. It gives users a credit line up to ₱200,000 via a mobile app and Mastercard (physical and virtual).

Purchases can be split into interest-free short-term payments or longer installments for a fee. Because there are many ways to pay (BNPL apps, loan apps, credit cards, digital banks, etc.), people compare options to find the best fit.

For example, GoTyme Bank is a digital debit account (no credit), BillEase and Salmon are app-based installment services, SPayLater and Grab PayLater are BNPL tools linked to Shopee and Grab, and Tala offers short-term cash loans. UnionBank and other banks issue traditional credit cards.

Home Credit provides point-of-sale financing for appliances and gadgets. Each has different limits, rates, and approval rules. Knowing the key differences helps you pick what matches your spending habits and repayment ability.

Atome vs GoTyme

Key differences:

- Atome is a BNPL service issuing a Mastercard credit card, while GoTyme is a digital bank account with a Visa debit card.

- Atome offers a credit line (up to ₱200K) with 0% installments, whereas GoTyme has no credit line – it’s funded by your own deposits.

- Atome lets you earn interest on saved funds and use its card for shopping, GoTyme focuses on banking features (savings, rewards, no annual fees).

- GoTyme approval is instant since it’s a bank account; Atome approval is quick (minutes) but still requires KYC for credit.

Pros of Atome:

- Offers interest-free payment period (up to ~40 days) and installment plans.

- Accepted anywhere Mastercard is allowed, including overseas (though forex fees apply).

- No annual or hidden fees on the card; earn up to 3.25% on savings.

- Fast online application and relatively high credit limit.

Pros of GoTyme:

- No debt: only use your own balance (debit card).

- Earn rewards points on every spend, plus interest on savings.

- No annual fees or hidden charges on the bank account.

- Instant approval for account opening and easy digital features (free transfers, etc.).

Who should choose which:

- Atome is better if you need short-term credit for purchases, or want flexible installments, and if you shop both online and in stores.

- GoTyme suits those who prefer saving with a digital bank, earning rewards, and avoiding loans/interest altogether. It’s ideal for users who don’t want credit but want easy banking.

Atome vs BillEase

Key differences:

- Both Atome and BillEase are BNPL providers, but Atome issues a Mastercard (usable anywhere Mastercard is accepted) while BillEase is an app-based service limited to partner merchants.

- Atome offers higher credit limits (up to ₱200K) versus BillEase’s typical limit (~₱40K).

- Atome provides 0% interest up to 40 days (then monthly fees if converted to installments), whereas BillEase has a monthly interest on loans (with occasional 0% promos at certain stores).

- BillEase approval is usually instant or same-day, but requires an app sign-up and documents. Atome also has quick approval with a simpler online process.

Pros of Atome:

- Larger spending limit and a card that works in more places (physical stores, online, international).

- Can split a single bill into 3- or 6-month installments if needed.

- Earn interest on wallet balance, and get 0% deals at many retailers.

- Quick online setup and application.

Pros of BillEase:

- Instant approval with minimal requirements (usually one valid ID and basic info).

- 0% installment promotions are often available for partner brands and stores.

- Can be used on Lazada, Shopee, or BillEase partner sites without a credit card.

- The app also lets you pay bills, loads, and fund wallets on installments.

Who should choose which:

- BillEase is great for online shoppers who need quick, small-to-medium credit without a physical card. If you frequently shop on Lazada or partner stores, it’s convenient.

- Atome is better if you want higher credit and the flexibility to use a physical card. It’s good for bigger purchases or when shopping in places not partnered with BillEase.

Atome vs Salmon

Key differences:

- Both are credit lines, but Atome’s line can go up to ₱200K, while Salmon offers a much smaller limit (around ₱15K).

- Salmon acts like a mini credit card: you have up to ~62 days interest-free if you pay the balance in full each month. Atome gives ~40 days interest-free and then installment plans.

- Atome requires you to choose installment plans for longer terms (3–6 months with fees), Salmon typically expects full payment each cycle to avoid fees.

- Atome’s credit is tied to the Atome app and Mastercard; Salmon’s is through its own app and card.

Pros of Atome:

- Much higher credit limit, useful for larger expenses.

- Flexible repayment: interest-free short-term or longer installments if needed.

- Accepted anywhere with Mastercard.

- Save money in the app and earn interest.

Pros of Salmon:

- Easy installment approach with no interest if you pay on time each month (up to ~62 days grace period).

- Smaller commitment, so it’s easy to track; no risk of large debt.

- Instantly approved line for small purchases, good for beginners with little credit history.

Who should choose which:

- Salmon works well for someone wanting just a little bit of credit for small buys or trying out a credit-like tool without lengthy processes.

- Atome is better for bigger needs – if you often spend more (electronics, travel, etc.) and want more flexibility and higher credit.

Atome vs Credit Card

Key differences:

- Atome is a BNPL card app with interest-free periods; a traditional credit card is a bank-issued card that requires at least minimum payments monthly.

- Atome usually has no annual fee and needs no credit history; credit cards often have annual fees, require income proof, and build a credit rating.

- Both are Mastercard (or Visa) networks and are accepted widely, but credit cards generally have higher limits and perks (rewards, miles, insurance) built in.

- With Atome, you choose installment plans for longer payments. Credit cards automatically revolve the debt with a minimum due.

Pros of Atome:

- Fast approval without long credit checks (no annual fee, no lock-in).

- Clear installment options and an interest-free offer up to 40 days.

- Earn up to 3.25% interest on any money you keep in your Atome account.

- Useful for travelers (up to ₱200K limit, works overseas).

Pros of Credit Card:

- High spending limits (often much more than Atome).

- Potential rewards, cashback, travel benefits, or loyalty points on spends.

- Builds your credit history when used responsibly.

- Can carry a balance (with interest) but has a revolving line.

Who should choose which:

- Credit Cards are ideal if you need very high limits, want rewards programs or are comfortable managing revolving credit. They suit established borrowers.

- Atome is for those who want an easy BNPL option without applying for a bank credit card. It’s good for people who prefer short-term interest-free payback and do not want annual fees or require long credit checks.

Atome vs Home Credit

Key differences:

- Atome offers a virtual/physical Mastercard and online installment plans; Home Credit provides point-of-sale financing at partner retailers (electronics, appliances, furniture).

- Atome can be used anywhere Mastercard is accepted (online or offline), while Home Credit financing is limited to in-store partners.

- Atome’s typical payback is a few months, whereas Home Credit often offers longer terms (up to 12 or 18 months).

- Home Credit usually requires purchasing a product from a store to get financing, Atome can be used for various purchases and has its own app.

Pros of Atome:

- Use for travel bookings and e-commerce, not just store items.

- No lengthy store visits—everything done through app or with card.

- Can split payments into flexible installments with some 0% deals.

Pros of Home Credit:

- Designed for big-ticket items (appliances, gadgets).

- If you’re buying from a store that has Home Credit, you can split costs into longer plans.

- Sometimes offers seasonal promos (e.g., 0% deals during mall sales).

Who should choose which:

- Home Credit is suited for shoppers buying high-priced appliances or furniture at partner outlets who need more time (6–18 months) to pay them off.

- Atome is better for shoppers who also want online convenience, travel, or retail shopping in places that Home Credit doesn’t cover. It’s more versatile for different types of purchases.

Atome vs SPayLater

Key differences:

- SPayLater (Shopee PayLater) is a BNPL feature tied to Shopee’s ecosystem; it’s primarily for paying on Shopee or other Sea platforms. Atome is a standalone BNPL card/app usable anywhere Mastercard/Visa is accepted.

- SPayLater offers a credit limit (often up to tens of thousands) but generally smaller than Atome’s. It gives interest-free days if you pay by the due date; otherwise, it charges monthly interest.

- Atome requires no lock-in with one retailer, and it has a physical card that can be used outside Shopee, while SPayLater is app-only.

- Approval for SPayLater is instant once you qualify with SeaMoney. Atome’s approval is fast too, but is a separate sign-up process.

Pros of Atome:

- More flexible usage (travel sites, physical stores, other online shops) beyond Shopee.

- The Atome Card functions like a credit card globally (with some foreign fees).

- Earn interest on idle funds in the Atome app.

Pros of SPayLater:

- Seamless checkout on Shopee with one tap; often integrated discounts with Shopee promotions.

- Good for frequent Shopee users and promotional campaigns (like pay-later free months).

- Quick approval if you already have a Shopee/ShopeePay account.

Who should choose which:

- SPayLater is great if you mainly shop on Shopee or Sea services and want straightforward pay-later checkout there.

- Atome is better if you want a broader option beyond Shopee – for example, if you shop on Lazada, travel sites, dine out, or use other retailers, Atome’s card can be used in more places.

Atome vs UnionBank Credit Card

Key differences:

- Atome is a BNPL app/card issued by a fintech (Ascend Money); a UnionBank credit card is issued by UnionBank of the Philippines.

- Both provide credit lines via a card, but UnionBank CC is tied to a bank account and standard credit underwriting, while Atome is app-first with simpler sign-up.

- UnionBank credit cards often have annual fees and interest rates on carried balances; Atome has no annual fee and uses interest-free periods for purchases.

- Atome offers extra services (savings account, micro-loans) in its app, whereas UnionBank’s app focuses on banking features and card management.

Pros of Atome:

- No annual fee, no paperwork beyond the app.

- The card can be used internationally (as a Mastercard).

- Quick approval (minutes) even without an extensive credit history.

- Earns interest on any money kept in the Atome wallet.

Pros of UnionBank Credit Card:

- Potentially higher credit limit and broad bank-backed support (customer service, disputes, etc.).

- Rewards points and cashback programs that come with bank cards.

- Tied to UnionBank’s digital banking ecosystem (transfer funds easily, etc.).

- Traditional credit card perks (insurances, lounges, promos).

Who should choose which:

- UnionBank Credit Card is for those who want a full-fledged credit card with all the usual bank benefits and have no issue meeting bank requirements (income, etc.).

- Atome is an alternative if you want credit card–like functionality without the fuss of approval hurdles. It suits newcomers to credit or anyone who prefers app-based control.

🎉 Win Up to ₱6,000 Cashback or an iPhone!

Sign up for an Atome Card using my link and get a chance to enjoy exclusive rewards. Registration is quick, easy, and 100% online.

👉 Register for Atome Card Now*Promos are subject to Atome Philippines’ terms and availability.

Atome vs Tala

Key differences:

- Atome is for paying merchants: you use it to purchase things now and repay later. Tala is for borrowing cash: you get a cash loan and spend it as you like.

- Atome has interest-free periods (if paid on time) and offers installments; Tala charges a fixed interest rate on cash loans (typically higher).

- Atome repayment is tied to purchases; Tala repayment is scheduled (often in a few months or one lump sum).

- Tala approval is instant for small amounts (a few thousand pesos), Atome is instant for a credit card line (tens of thousands).

Pros of Atome:

- Designed for purchases, not cash needs, with 0% deals and flexible installments.

- Earn 3.25% interest on any money kept in your Atome account if you top it up.

- It can cover big purchases or trips and divide them into manageable payments.

Pros of Tala:

- Fast cash loans without collateral, great if you need immediate cash (for emergencies, bills, etc.).

- Quick approval and disbursement (money can be in your account the same day).

- Helps in urgent situations when you can’t use a credit card or BNPL for cash.

Who should choose which:

- Tala is suited for someone who needs cash on hand immediately and plans to pay a short-term loan (e.g., for emergency expenses).

- Atome is better if you want to buy a product or service now and spread the payment with potentially lower cost (no interest if repaid fast). For routine shopping, Atome can replace going to loan apps.

Atome vs Maya Credit

Key differences:

- Maya Credit (the credit feature in the Maya e-wallet app) provides a credit line that you can spend by topping up your wallet balance. Atome provides a Mastercard and a separate digital wallet.

- Both can be used at many places: Maya Credit works where Maya is accepted (also on Lazada through Maya), while Atome’s card works anywhere Mastercard is accepted.

- Maya Credit approval is instant (with an existing Maya account); Atome is also instant or very fast to approve.

- Maya loans (credit line uses) incur interest if not paid in full monthly; Atome has 0% period and then charges interest on installment plan uses.

Pros of Atome:

- Physical card plus virtual option, giving a true card experience.

- Often holds promotional 0% deals at partner stores.

- Earn interest on any cash held in the Atome app.

Pros of Maya Credit:

- Seamless experience within the Maya app (no need for a separate account).

- Use Maya Credit to top up your e-wallet or pay merchants supporting Maya.

- Maya often has its own rewards (coins) and money management tools.

- Instant access if you already use Maya for mobile load, bills, etc.

Who should choose which:

- Maya Credit is great if you are a heavy Maya/PayMaya user (e.g., you frequently top up e-wallet, pay via QR code, or Lazada wallet).

- Atome is better if you want a versatile credit card for a variety of purchases outside the e-wallet ecosystem, especially if you need higher credit.

Atome vs Grab PayLater

Key differences:

- Grab PayLater is a BNPL option within the Grab app for rides, deliveries, and partner merchants. Atome is a separate BNPL card/app.

- Grab PayLater credit is generally smaller (often under ₱20K) and limited to Grab’s services (and select partners). Atome offers up to ₱200K and can be used anywhere Mastercard/Visa is accepted.

- Both charge interest if you don’t repay on time, but Atome often has introductory 0% deals, whereas Grab PayLater’s interest rates vary per loan term.

- Approval for Grab PayLater is instant once you meet Grab’s criteria; Atome approval is also quick but requires a new signup.

Pros of Atome:

- Can be used for a wide range of purchases beyond the Grab ecosystem (shopping, dining, travel, etc.).

- Offers a physical card that works outside the app.

- 0% installments available for items bought with the card at many stores.

Pros of Grab PayLater:

- Convenient if you’re a frequent Grab user (rides, food delivery, shopping on GrabMart).

- Charges automatically with your Grab account, often with no hassle at checkout in-app.

- Sometimes, bundled promotions (free ride credits, discounts) for using PayLater.

Who should choose which:

- Grab PayLater is tailored for those who spend mainly on Grab services and want one less payment method to manage.

- Atome is for broader shopping needs — if you want to manage larger or more varied purchases in installments, or if you travel often, Atome’s card provides more flexibility.

Which Is Better for Filipinos: Atome or Other Payment Options?

- Students: Those without credit history often lean on BNPL. Atome, BillEase, or Salmon can give students easy spending power with minimal requirements. Credit cards and large loans are usually out of reach. BNPL allows them to pay for school supplies or laptops over time without a huge upfront cost.

- First-time credit users: People new to credit may find Atome or Salmon appealing because approval is simpler. Starting with BNPL can teach payment discipline before moving to full-fledged credit cards. However, responsible credit card use can also build a good credit score in the long term.

- Online shoppers: Shoppers on Lazada, Shopee, or travel sites benefit from BNPL like Atome, BillEase, or SPayLater because they integrate easily at checkout and often have promo deals. If you frequently use certain apps (e.g., Shopee), sticking with SPayLater might be easiest. Otherwise, Atome works across many stores.

- Big-ticket purchases: For large expenses (TVs, appliances, vacations), traditional loans or credit cards may be better due to higher limits or longer terms. Home Credit or bank credit cards often give more time to pay. Atome can cover big buys up to its limit, but if your cost exceeds that, a credit card or a retailer loan is needed.

- Short-term vs long-term credit needs: Atome is ideal for short-term borrowing (pay in a few months, often interest-free initially). If you only need credit for a couple of months, Atome or other BNPL is cheaper. For long-term financing (6+ months), loan apps or installment plans (Home Credit, Tala) might be more suitable, though they charge interest. Long-term credit cards (revolvers) are also an option but be cautious of compounding interest.

Choosing “better” depends on your habits and repayment ability. If you pay off each bill on time, Atome and other BNPL can be advantageous. If you need ongoing credit, a revolving credit card or loan might fit – but ensure you can handle the interest and minimum payments.