Buy Now, Pay Later (BNPL) is changing how Filipinos shop by making it easier to afford purchases without paying the full amount upfront. In simple terms, BNPL services let you buy something now and pay for it later – usually in equal installments over a few weeks or months.

This concept has quickly become popular in the Philippines, where many people don’t have credit cards but still want flexible payment options. Imagine being able to get a new phone, clothes, or gadget today through an app, and then gradually pay it off with your “hulugan” (installment) over time. It’s a convenient alternative to saving up for months or swiping a traditional credit card.

Filipinos are embracing BNPL apps because they offer instant installment plans often with low or even zero interest for short terms. Whether you’re a student on a tight budget or an online shopping addict eyeing the latest sale, these “pay later” services in the Philippines let you secure the item now and settle the bill in chunks aligned with your payday.

In fact, BNPL services in the Philippines have spread so fast that they’ve reached millions of users nationwide. This guide will explain what BNPL is, how it works locally, and how you can use it smartly. We’ll also introduce the top BNPL apps in PH and compare them with credit cards, so you’ll know exactly when and how to use these installment payment apps to your advantage.

By the end of this comprehensive guide, you’ll understand why Buy Now, Pay Later Philippines has become a buzzword among shoppers, and how to make the most of these services without running into trouble. Let’s dive in and see how BNPL works and why it’s become a go-to solution for many Filipinos looking for interest-free installment options and flexible payments.

What Is Buy Now, Pay Later (BNPL)?

Buy Now, Pay Later (BNPL) is a type of payment plan that lets you purchase an item immediately and pay for it over time instead of paying the whole price upfront. It’s basically an installment plan made super easy – typically arranged through a mobile app or at an online checkout.

Unlike traditional layaway (where you only get the item after full payment) or a credit card (where you might incur interest if you don’t pay your bill in full), BNPL lets you take home or receive your purchase right away while splitting the cost into smaller installments.

Here’s a simple real-world example: suppose you want to buy new sneakers that cost ₱3,000. With a BNPL service, you could pay just ₱1,000 now and then ₱1,000 each month for the next two months, often at 0% interest.

Essentially, the BNPL provider pays the store on your behalf, and you repay the provider in parts. It’s like having a short-term mini loan for shopping, but arranged on the spot with just a few taps on your phone.

One way to think of BNPL is as an “installment payment app”. In the Philippines, many people might compare it to the old concept of “hulugan” from appliance stores, where you pay in installments – but BNPL modernizes this. There’s no need for a credit card or lengthy bank loan process.

The terms are usually straightforward: for example, “Pay in 3 monthly installments” or “Pay 25% now and the rest later.” As long as you pay on schedule, some plans won’t charge you any extra. This is why you’ll hear BNPL advertised as “interest-free installment” plans for shoppers.

To put it simply, BNPL lets you get what you need now and pay later under agreed terms. It’s an attractive option if you don’t want to shell out a big amount in one go or if you’re waiting for your next sweldo (salary).

However, remember that “pay later” isn’t “pay never” – you do have to budget for those upcoming installments. We’ll talk more about how it works and the responsibilities that come with it, but at its core, BNPL is all about convenience and flexibility for buyers.

🎉 Win Up to ₱6,000 Cashback or an iPhone!

Sign up for an Atome Card using my link and get a chance to enjoy exclusive rewards. Registration is quick, easy, and 100% online.

👉 Register for Atome Card Now*Promos are subject to Atome Philippines’ terms and availability.

How BNPL Works in the Philippines

Understanding how BNPL services work in the Philippines is pretty straightforward. Here’s a step-by-step look at the typical process from sign-up to purchase and repayment:

- Signing Up for a BNPL App: First, you download the BNPL app or enable the service (if it’s built into an existing app like GCash or Shopee). You’ll need to create an account and provide some personal details. BNPL eligibility in the Philippines is usually simple – you must be at least 18 years old, have a valid ID, and often a Philippine mobile number.

Most apps will ask you to verify your identity (such as taking a selfie and an ID photo) and sometimes your income source or employment, though proof of income isn’t always required for initial approval. The sign-up is much faster and easier than a credit card application; in many cases, approval is instant or within a few hours. Even those without a credit history (like students or new graduates) can get approved for a starter spending limit on these BNPL apps in PH. - Getting Approved and Your Spending Limit: Once you’re verified, the BNPL provider will give you a credit limit or maximum amount you can spend using their service. This might start small (for example, ₱2,000–₱10,000 for new users) and can increase over time as you use the app responsibly. This limit isn’t cash you can withdraw; it’s the maximum value of purchases you can finance through the BNPL service at any given time.

Think of it as your BNPL “wallet” for shopping. Different services have different caps – some, like Atome BNPL or BillEase, might raise your limit after you successfully repay your first few purchases. Others like GCash GCredit/GGives determine your limit based on factors such as your GCash usage and credit score. The key point is that approval is more accessible than traditional bank credit. Many young Filipinos who don’t qualify for credit cards find they can still use BNPL for installment purchases. - Shopping and Choosing BNPL at Checkout: Now comes the fun part – using BNPL to buy something. You can shop online or in-store, depending on the app:

- Online: When you’re buying from an online store or e-commerce site (for example, shopping on Lazada or a gadget website), look for BNPL options at checkout. Many merchants in the Philippines have integrated BNPL providers. You might see buttons like “Pay with BillEase,” “Install with Atome,” or “Shopee PayLater” as a payment option. If you select that, the app will typically show you a breakdown of the installment plan (e.g. “Pay ₱___ now, then ₱___ per month for 2 more months”). Confirm the plan, and the purchase will be completed with the BNPL provider covering the cost upfront to the merchant.

- In-Store: If you’re in a physical shop, some BNPL services let you use them at the point of sale. For instance, Atome has partner stores where you can scan a QR code or use the Atome app to generate a payment barcode for the cashier. GCash GGives works wherever GCash is accepted – you just tell the cashier you’ll pay via GCash, scan the QR code, and in your GCash app choose the GGives option to split the payment. There’s even an Atome Card (a Mastercard powered by Atome) that you can swipe or use online anywhere, and it converts the purchase into your BNPL installment plan. In short, BNPL isn’t just for online shopping; many services have ways to be used in malls, restaurants, or stores that partner with them or accept their allied payment methods.

- Payment Terms and Installment Schedules: The hallmark of BNPL is splitting the cost into smaller payments. Commonly in the Philippines, BNPL plans are in 3 installments (spread over 3 months) with zero interest – this is a very popular option because it’s simple and often fee-free. Some services also offer 6, 9, or 12-month plans especially for bigger purchases (like appliances or gadgets), though longer terms might come with a small interest or processing fee.

For example, GCash GGives can stretch up to 12 months, and BillEase can offer 3, 6, or 12 months (with interest for 6 and 12). Shopee PayLater can do 1 up to 12 months as well, depending on your account standing. Each installment is usually due monthly (e.g., every 30 days after the purchase), but a few services operate on a bi-weekly schedule for shorter plans (international BNPLs do this; in PH it’s mostly monthly due dates).

Typically, you might pay the first installment at checkout (some apps charge the first payment immediately), while others might defer the first payment by a couple of weeks. The app will clearly tell you your payment schedule – say, “₱1,000 today, then ₱1,000/month for the next 2 months, due every 15th of the month.” - Repaying the Installments: Once your purchase is done, you need to make sure you pay each installment on time. BNPL apps make this easy by sending reminders and updates. Depending on the service, you might need to manually pay by clicking a button in the app (funding it via your bank, e-wallet, or debit card each time), or it might auto-debit from a linked source.

For instance, if you used GGives, GCash will automatically deduct the installment amount from your GCash wallet on the due date (so you must have sufficient balance on that day). With Shopee PayLater, the amount due is added to your Shopee account bill, and you pay it in the app or it auto-debits your card if you set it up that way.

The key is timely payment – if you pay on schedule, you keep enjoying the service without extra charges. If you pay off everything early, some BNPL apps even allow that without penalties, which can be a good way to manage debt. - Where You Can Use BNPL: BNPL started online but has expanded. In the Philippines, you can use BNPL for:

- E-commerce purchases: on platforms like Shopee, Lazada (through partners like BillEase or TendoPay), Zalora, and countless smaller online stores that have partnered with BNPL providers. If you’re buying gadgets from sites like Kimstore or shopping fashion on Zalora, chances are there’s an “installment payment” option via a BNPL.

- Mobile apps and services: The Shopee app has its own Shopee PayLater. GCash app has GGives and GCredit. Even Grab has a PayLater feature (for Grab rides/food, letting you accumulate a bill and pay later in the month). So if you’re using these popular apps, BNPL might be built right in.

- In physical retail: Many brick-and-mortar shops, especially those selling electronics, appliances, and even travel agencies, are starting to offer BNPL as a payment option. For example, some official Apple resellers and gadget stores allow payment via GCash GGives or Home Credit (which is a similar installment lender).

If you walk into a mall store and see logos of Atome, BillEase, or Home Credit at the cashier, it means you can buy that item now and pay later via those services. The Atome Card (and similar virtual cards from BillEase or Maya) further allow you to use BNPL anywhere by acting like a credit card – so you could theoretically use BNPL for anything from buying groceries to booking a flight, as long as you have the card and a sufficient limit. - Apple products and other big-ticket items: A lot of Filipinos aspire to buy Apple devices (iPhone, MacBook, iPad) which are quite expensive. Traditionally, you’d need a credit card with a high limit or find a 0% installment promo. Now, BNPL has stepped in as another option. Some Apple resellers (like Power Mac Center or Beyond the Box) partner with services like GGives or offer their own installment plans.

You might see promotions like “Get your dream iPhone for 12 easy payments with 0.9% interest via GGives!” – meaning you can use your GCash’s BNPL feature to grab that iPhone. So BNPL for Apple products is definitely a thing in PH: you could use Atome or BillEase online if the store supports it, or GGives in-store, to break down that ₱50k iPhone into manageable chunks.

- E-commerce purchases: on platforms like Shopee, Lazada (through partners like BillEase or TendoPay), Zalora, and countless smaller online stores that have partnered with BNPL providers. If you’re buying gadgets from sites like Kimstore or shopping fashion on Zalora, chances are there’s an “installment payment” option via a BNPL.

In summary, BNPL works by providing an on-the-spot installment plan for your purchases. You sign up once, then whenever you use it, the service handles paying the store while you handle paying the service back over time.

It’s a smooth process that’s embedded into many shopping experiences now. But with great convenience comes the need for responsibility – it’s easy to get carried away, so you’ll want to use these services wisely (more on that later). Now that you know how BNPL operates, let’s look at the popular apps offering these services in the Philippines.

Popular BNPL Apps in the Philippines

The Philippine market has several BNPL providers and platforms. Each has its own features and partner stores, but they all let you split payments into installments. Below is an overview of some popular BNPL apps in PH and what they offer:

- Atome – Atome is a leading BNPL app that originated in Singapore and expanded to the Philippines. It allows you to split purchases (usually into 3 monthly payments at 0% interest for partner merchants). Many fashion and lifestyle stores, both online and in malls, accept Atome. Example scenario: You’re buying a ₱6,000 watch from a partner store. With Atome, you pay ₱2,000 at checkout, then ₱2,000 per month for the next two months, interest-free.

I found the Atome app very user-friendly – I signed up with one ID and got approved in minutes. At the store, the cashier had an “Atome” QR code; I scanned it using my Atome app, and it instantly processed my first payment. It felt like magic to walk out with the watch by just paying a third of the price upfront. Atome sends reminders for the next payments, which I just paid through the app. It’s great for shoppers who frequent Atome’s partner brands. - Atome Card – The Atome Card is an extension of Atome’s service in partnership with Mastercard. It’s basically a BNPL-powered credit card (physical and virtual) that you can use anywhere Mastercard is accepted, not just specific partner stores. When you use Atome Card for a purchase, it doesn’t charge you interest if you pay the full amount within up to 40 days.

If you need longer, you can convert the purchase into an installment plan (up to 6 months) via the Atome app. There are no annual fees. Example scenario: Suppose you have the Atome Card and you swipe it to pay ₱4,500 for groceries at the supermarket. That amount is added to your Atome account. If you pay back the ₱4,500 in full by the due date (within 40 days), you pay no interest at all – essentially a short-term loan for free.

If you prefer, you could split it into, say, 3 monthly payments of ₱1,500 via the app. This product is great if you want the flexibility of a credit card installment but without going through a bank credit card application. It essentially brings the buy now, pay later concept to any store or online site through the power of Mastercard. Atome Card in the Philippines can have a high limit (some users report limits up to ₱200k if you qualify), making it useful for bigger purchases too. - Shopee PayLater (SPayLater) – Shopee PayLater is the BNPL feature inside the Shopee Philippines shopping app. If you’re a frequent Shopee user, you’ve probably seen it as an option at checkout. With SPayLater, selected users can buy items on Shopee and pay next month or in several monthly installments. Example scenario: Let’s say you have ₱2,000 worth of items in your Shopee cart but it’s two weeks away from payday.

By using Shopee PayLater, you could choose a “Buy now, pay next month” option and only pay for that ₱2,000 after 30 days, giving you breathing room. Alternatively, you might split it into 3 monthly payments of around ₱700 each. Shopee often promos 0% interest for short-term installments (1-3 months) on SPayLater, though a small processing fee might apply. To use it, you activate SPayLater in the app (Shopee will ask for ID verification, and not all users get immediately eligible – they usually offer it to users with good purchase history).

Once activated, it’s seamlessly integrated: at checkout, just pick “Shopee PayLater” as the payment method. Shopee PayLater Philippines is very convenient for online shoppers since you don’t leave the Shopee ecosystem at all. Just be mindful of the due dates shown in the app; if you miss a payment on SPayLater, Shopee will charge late fees and could block your ability to place new orders. - GCash GGives – GGives is the installment loan feature offered by GCash, the most popular e-wallet in the Philippines. If you have the GCash app, you might notice “GGives” in the menu. It allows qualified users to split purchases into 3, 6, 9, or 12 payments. GGives can be used at any store (online or offline) that accepts GCash QR or Pay with GCash checkout. Example scenario: You need a new washing machine for your home that costs ₱12,000.

The store accepts GCash as payment. At the cashier, instead of paying ₱12k in one go, you choose to use GGives. The GCash app lets you select, say, a 12-month plan. You might pay around ₱1,100 per month for 12 months (GGives does charge a low interest – often around 0.5% to 0.9% annually for promos, or up to ~5% monthly for some terms depending on your GCash score). The great thing is there’s no down payment and no hassle – the first payment isn’t due immediately, it might start 1 month after. GCash deducts the monthly amount automatically from your wallet balance on the due date. Many Filipinos use GGives for gadgets and appliances; for example, I’ve seen deals like “Upgrade your Apple gear via GGives at 0.9% interest per month.”

This means an iPad or iPhone can be taken home with no cash out today and just pay through GCash over time. GGives’ advantage is its reach: since so many merchants take GCash, you effectively have a wide network to use this installment payment app. Just remember GGives is a loan – if you don’t pay your GCash dues, your account can be frozen or you might face collections via Fuse Lending (the lending arm behind GCash). - BillEase – BillEase is a homegrown Filipino BNPL service (by First Digital Finance Corp) that’s very popular for online shopping installments in PH. It’s widely accepted on Lazada (as a payment option), on airlines like Cebu Pacific’s website, and a ton of online shops for electronics, home goods, and more. With BillEase, you can do 0% interest for short terms (typically 3 months) at select merchants, or opt for longer terms up to 12 months with interest. Example scenario: You’re eyeing a laptop on Lazada for ₱30,000. You don’t have a credit card.

At checkout, you choose BillEase as the payment method. BillEase approves your purchase (they may ask for a down payment, say 20% upfront = ₱6,000). Then you can pay the remaining ₱24,000 in 6 monthly installments of about ₱4,000 + interest. The app will show you the exact figures. What users like about BillEase is that it’s quite flexible – you can also use your BillEase credit limit to pay bills, buy load, or even get a virtual prepaid card for one-time use on websites. It integrates well with many merchants, making it a go-to pay later app for Filipinos who shop online.

Just like others, you need to pay on time via their app (you can cash in via GCash, bank transfer, etc., to pay your dues). BillEase will increase your limit if you build a good track record, allowing you to finance bigger purchases over time. - Others (Home Credit, etc.) – Aside from the big names above, there are other services worth mentioning:

- Home Credit: A familiar name to many mall-goers, Home Credit isn’t an app-based BNPL but rather an in-store installment lender. You’ve probably seen their booths in appliance stores or gadget shops. They offer financing for a single item where you fill out forms in-store. It’s like BNPL in that you get the item immediately and pay later in installments, but it’s a more traditional approach (with interest and a longer application). Now, Home Credit also has a mobile app and some partnerships to stay competitive with app-based BNPLs.

- Plentina: An app that started with load and bill installments but also partners with some merchants for BNPL. It’s a smaller player but has unique offers like installment vouchers for specific stores.

- TendoPay: Another installment app especially used for online shopping. Similar model to BillEase – you apply for a credit line and use it at partner e-commerce sites.

- Maya PayLater: Maya (formerly PayMaya) has been introducing credit features as well. They have a “Pay in 4” installment plan for certain purchases and a general cash loan. It’s not as widely publicized as GCash’s offerings, but as Maya grows as a digital bank, we may see more BNPL-style features from them.

- Grab PayLater: If you use Grab for rides or food delivery, Grab’s PayLater lets you accumulate your Grab transactions and pay them all at once every month, or sometimes split into installment if allowed. It’s a small-scale BNPL (limited to Grab services), but worth noting for heavy Grab users.

- Credit Card Installment Plans: While not BNPL apps, it’s worth mentioning that many credit cards in the Philippines offer “0% installment” at certain stores or via their apps (even converting a purchase into installments via the bank’s app). This is the traditional alternative to BNPL. If you have a credit card, sometimes using its installment feature might be simpler. But since we’re focusing on BNPL alternatives accessible to those without cards, these bank programs are the competition rather than direct BNPL apps.

Each of these BNPL options has its own strengths. Shopee PayLater is great if you basically live on Shopee. Atome and BillEase are excellent for a variety of online and offline stores. GCash GGives leverages the ubiquity of GCash. Atome Card and similar virtual cards give you the freedom of a credit card with BNPL flexibility.

When choosing one, consider where you shop most and what kind of payment terms you need. In fact, you can use multiple BNPL services – for example, use SPayLater on Shopee, BillEase on Lazada, and GGives for in-store purchases. Just be careful not to over-extend, which leads us to comparing BNPL with traditional credit cards and understanding the pros and cons.

BNPL vs Credit Cards

How does Buy Now, Pay Later compare to the traditional credit card? They both let you delay payments, but they work differently and have distinct pros/cons. Let’s break down the key comparisons for Filipino consumers:

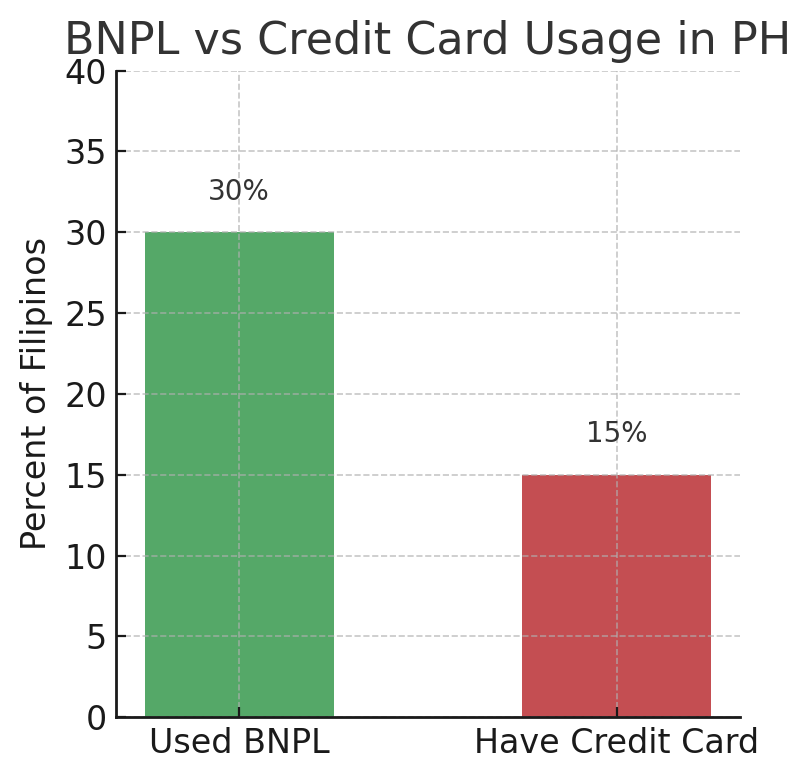

The bar chart above compares the reach of BNPL vs credit cards in the Philippines: roughly 30% of Filipinos have used BNPL services, whereas only about 15% have a credit card. BNPL’s accessibility has enabled many people without bank credit to still shop on installment. This highlights one major difference – accessibility.

In the Philippines, getting a credit card can be tough: banks require proof of steady income, a good credit history, and a lot of paperwork. Many young adults and students simply don’t qualify. BNPL apps, on the other hand, are easy to join with just a valid ID and smartphone, so they’ve onboarded millions who would otherwise have no access to credit. In short, BNPL is more inclusive for the average Filipino, while credit cards are still somewhat of a luxury or require financial maturity to obtain.

Approval & Eligibility: As mentioned, virtually anyone 18+ with the required ID can try BNPL, and approvals are often instant for a starter limit. Credit cards require a formal application to a bank, proof of income (usually a stable job with a minimum salary), and a waiting period of days or weeks for approval – and many applications get denied if you don’t meet strict criteria. So if you’re a freelancer, part-timer, or just starting out, BNPL is far more attainable.

Interest and Fees: BNPL services often market themselves as “0% interest” – and indeed, for short-term plans (like 3 months), most BNPL apps charge no interest as long as you pay on time. Some may have a small processing or service fee per transaction (for example, a fixed admin fee, or a percentage if you choose a longer plan). Credit cards, in contrast, will charge interest (usually 2-3% per month on the remaining balance) if you don’t pay your full balance by the due date.

However, credit cards also offer 0% installment deals at certain stores (the store basically shoulders the interest for you as a promo). The difference is, with a card you often need to ask for that installment conversion or it’s only at partner merchants; with BNPL the 0% for 3 months is a standard offering at many places. Late fees apply on both if you miss payments – BNPL apps typically charge a flat late fee or a percentage of the amount due (like ₱50 to ₱300, or 1-5% of the installment, depending on the provider). Credit cards charge hefty late payment fees and interest on the overdue amount.

One could argue BNPL is more forgiving for short-term use (since you can avoid interest entirely), whereas credit cards can become very expensive if you carry a balance. On the flip side, credit card users can dodge interest by paying their full balance monthly (essentially using the card free for up to 45 days), similar to how BNPL users pay no interest on short plans.

Spending Limit: Credit cards usually provide a higher credit limit if you have the income to back it. BNPL limits start small. For example, a new BNPL user might only get a ₱5,000 limit initially, while a credit card for someone with a decent salary might start at ₱20,000 or more. Over time, BNPL limits can increase (some go up to ₱50k or ₱100k+ for top users, especially with things like Atome Card or GGives).

But generally, if you need to make a really big purchase (like ₱100k furniture set), a credit card might be more straightforward if you have one, since BNPL might not approve such a large transaction for an average user. Use case: BNPL is fantastic for small-to-medium purchases like clothes, gadgets, appliances, typically maybe under ₱20k each. Credit cards can handle those and more, but again, only if you have one.

Acceptance (Where You Can Use It): Credit cards win for universal acceptance. You can use a Visa or Mastercard almost anywhere – online, supermarkets, restaurants, travel booking, etc. BNPL is limited to specific merchants or platforms. You can’t just decide to use BNPL to pay your hospital bill or at a random store unless they have a partnership or if you use a BNPL-linked card like Atome Card. So, credit cards are more versatile in general.

However, as noted earlier, BNPL coverage in PH is growing – with BNPL cards and integration into wallets, the gap is closing for shopping scenarios. Still, you can’t pay your monthly electric bill or your rent with BNPL (in contrast, some people do pay bills with credit card to get points then pay later, etc.).

Rewards and Perks: Credit cards often come with rewards programs: cashback, air miles, points for every spend, plus perks like travel insurance or airport lounge access. BNPL apps typically do not have such reward systems (at least not as elaborate).

They might have promos like refer-a-friend bonuses, first-time user discounts, or occasional merchant promos (e.g., “₱500 off if you pay with BillEase for the first time”). But you won’t earn points on every BNPL transaction in a way that a credit card would give you points. So if you’re someone who maximizes credit card rewards and pays off the card monthly, a credit card can be more rewarding. BNPL is more bare-bones: its perk is the installment plan itself and ease of use.

Budgeting and Discipline: BNPL breaks down each purchase into a set plan – which can actually help some people budget, because you know you owe a fixed ₱X for the next Y months for that item. Credit cards give you a revolving line – you can keep spending up to your limit, and you’re only required to pay a minimum each month (which can lead to debt if you only pay the minimum).

In a sense, BNPL enforces a short repayment period on each purchase, whereas credit cards let you stretch payments indefinitely if you’re okay with interest (not a great idea, but many fall into that trap). For disciplined users, credit cards provide flexibility (you could take a one-year installment on your own by just paying a portion, but at a high interest cost).

For the less disciplined, BNPL’s structured plan might prevent you from just paying a tiny amount and kicking the can down the road – you have to finish paying in a few months, which might keep you more accountable. However, overspending is a risk on both. BNPL can give a false sense that you have more money than you do (“It’s only ₱500/month, let me also BNPL this other item…”) and you might stack multiple BNPL plans without realizing your total obligations. Credit cards similarly can lead to overspending because you don’t feel the pain until the bill arrives.

Impact on Credit Score: In the Philippines, paying your credit card responsibly helps build your credit history – banks report to the credit bureaus, so having a well-managed credit card can boost your credit score over time. BNPL services currently have a limited impact on your formal credit score. Most BNPL providers do not report your on-time payments to the Credit Information Corporation (the centralized credit bureau) yet.

That means using BNPL won’t build your credit profile like a credit card can. However, if you default or fail to pay BNPL obligations, the provider may eventually report it or turn it over to collections, which could end up in your credit record negatively.

Also, if in the future you apply for a loan, some lenders might ask if you have existing BNPL debts (they’re not always visible on a credit report, but some advanced scoring knows if you have such apps). The bottom line: BNPL is great for access and convenience, but it’s not a tool for building creditworthiness in the eyes of banks; a credit card is (if used properly).

In a fair comparison, BNPL vs credit card isn’t about which is universally better – it’s about what fits your situation. BNPL services in the Philippines excel at being user-friendly, accessible, and good for short-term, smaller purchases.

Credit cards excel at wider acceptance, higher credit lines, and long-term financial building (with rewards). Many Filipinos actually use both: for instance, use BNPL for certain online shopping where it’s available, but also have a credit card for other expenses and emergencies.

If you don’t have a credit card or prefer not to get one, BNPL is a strong alternative to enjoy interest-free installments Philippines-style. If you do have a credit card, you might still use BNPL if it offers a better deal or promo for a specific purchase (e.g., some expensive item at a store offering 0% via BNPL but not via your card).

Just remember that in either case, you’re taking on debt that you must pay later. Be responsible with both BNPL plans and credit card bills to keep your finances healthy.

Pros and Cons of BNPL Services

Like any financial tool, BNPL has its advantages and disadvantages. Let’s outline the pros and cons of using BNPL services in the Philippines:

Pros of BNPL:

- Easy Access & Fast Approval: It’s very easy to start using a BNPL app. You don’t need a high income or a long credit history. With just a valid ID and a few personal details, you can get approved quickly. This means even students and fresh graduates can access a bit of credit to buy what they need. No lengthy bank forms or interviews – some apps approve you in under 10 minutes.

- No (or Low) Interest for Short Term: Most BNPL services offer interest-free installment plans, especially the short-term ones (e.g., 3 months). If you pay on time, you often pay exactly the same price as the item’s retail price, with no extra charges. This is a huge plus – you’re essentially getting a free short-term loan. Even when interest is charged for longer terms, it’s usually a fixed low rate. For example, an interest of 4% per month on a 6-month plan might sound high compared to a bank loan, but since the duration is short and the principal is small, it remains manageable.

- Budget-Friendly Payments: Breaking a large expense into smaller chunks can make it fit your monthly budget. Instead of a one-time ₱15,000 hit, paying ₱5,000 over 3 months feels lighter on the wallet. This allows people to buy essentials (or even non-essentials) without waiting months to save up. It’s great for when you have an urgent need (say your phone broke and you need a replacement now to continue working/learning online).

- Convenient and Seamless: BNPL is often integrated right into your shopping flow. If you’re checking out online, selecting a BNPL option is just as quick as selecting a payment method. There’s no separate trip to the bank or calling a loan officer – everything is done in-app or on the website in seconds. Apps send you reminders for payments, and some auto-deduct, so it’s quite hassle-free. It feels very user-friendly, especially for the tech-savvy generation used to doing everything on a smartphone.

- No Annual Fees or Maintenance Charges: Unlike credit cards which may have annual fees or require maintaining a certain spend to waive the fee, BNPL apps generally have no signup cost and no yearly fees. You only pay if you actually make a purchase on installment (and then, only what you agreed – no hidden charges if you pay on time). This means you can keep a BNPL account without worrying about charges in months you’re not using it.

- Helps in Emergencies or Sales: Imagine a big online sale like 11.11 or a limited-time promo on a flight ticket – it’s a great deal but payday is still a week away. BNPL can come to the rescue. You secure the deal now and pay later when your funds come in. Many Filipinos have used BNPL to take advantage of flash sales or to cover emergency purchases (like medicine or a laptop for work) when cash flow is tight.

Cons of BNPL:

- Can Encourage Overspending: The flip side of “buy now, pay later” is the temptation to overspend. When you only see a small installment amount (“₱500 per month” sounds much easier than “₱3,000 total cost”), you might end up buying more than you intended or purchasing items you don’t truly need. It’s easy to accumulate multiple BNPL plans across different apps and lose track of how much you owe in total. This psychological effect of “it’s just a small amount later” can lead to debt if you’re not careful.

- Multiple Bills to Track: Each BNPL purchase creates its own repayment schedule. If you have, say, three ongoing BNPL installments with different due dates (one with Shopee PayLater, one with Atome, one with GCash), you must keep track of each. Missing any one of them could result in late fees. It’s not as consolidated as a credit card statement that lists everything in one bill. Juggling several payment plans can be confusing, and without good personal accounting, one might slip through the cracks.

- Late Payment Fees and Penalties: While BNPL is often interest-free initially, it bites if you’re late. Companies will charge penalties for missed due dates. For example, a service might charge a flat ₱200 late fee for every missed payment, or 1-5% of the installment amount. If you keep missing, they can stack up, and your account could be frozen (meaning you can’t use the service until you settle everything). In some cases, chronic non-payment can lead to the company referring you to a collections agency. So the “free” part of BNPL only holds if you’re responsible; otherwise, costs can balloon.

- May Have Hidden Costs on Longer Terms: Not all BNPL plans are 0%. If you opt for longer installment durations, there could be interest or processing fees. For instance, some apps might show “3 months at 0%, 6 months at 5% interest total” etc. That means if you spread it out longer, you’ll pay more than the original price. It’s still often cheaper than a regular credit card’s revolving interest, but it’s a cost to consider. Always read the terms presented – some users get surprised to find they were charged a “service fee” or that the amount they totaled up is higher because they chose 6 months instead of 3.

- Doesn’t Build Credit Score: As discussed earlier, using BNPL won’t improve your credit history in the eyes of banks or lenders. So if your goal is to someday get a car loan or home loan, having a solid credit card record or bank loan record is helpful, whereas BNPL usage (even if you’re perfect at paying) usually doesn’t count. In a way, BNPL lives outside the traditional credit system. That’s not a direct “con” for daily usage, but it’s something to be aware of if you plan your long-term financial health.

- Limited Usage (Not Universal): You can’t use BNPL for everything. It’s great for shopping, but you can’t use it to pay your utility bills (with rare exceptions, like Plentina had some bill-pay feature). You can’t use it in a store that isn’t partnered or doesn’t accept the BNPL card. If you’re traveling abroad, your BNPL app might not work for purchases in other countries (unless you have something like Atome Card). Essentially, BNPL is not a replacement for having actual money or a generally accepted payment method in every scenario. There might be times you want to buy something but none of your BNPL options apply – in which case you need another way to pay.

- Risk of Debt Cycle: The ease of BNPL could lead some people into a debt cycle. For example, let’s say you have tight finances and you BNPL a bunch of stuff this month. Next month, you have to pay those installments, which means you have less free cash, which might tempt you to BNPL more things that month as well. If this continues, you’re constantly using next month’s income for last month’s purchases. It’s a bit like living paycheck to paycheck but compounded by installment obligations. Without discipline, you could find yourself needing to borrow more just to cover existing BNPL payments – a slippery slope.

In summary, BNPL services bring a lot of convenience and flexibility, especially for those who know how to budget and stick to a payment plan. The pros are significant: easy, often no interest, and helpful for making purchases fit into your budget.

However, the cons underscore why BNPL should be used responsibly. If you treat BNPL as “free money” or forget about the “pay later” part, you can get into financial trouble. It’s all about using it wisely: choose installments for things you truly need or really planned to buy, and avoid turning every whim into an installment just because you can. In the next section, we’ll discuss who benefits most from BNPL and who might want to think twice.

Who Should Use BNPL Apps?

BNPL apps can be useful for many people, but they’re especially suited for certain groups and situations. Here’s a look at who might benefit most from using BNPL services in the Philippines:

- Students and First-Time Credit Users: If you’re a college student or a recent graduate with no credit card, a BNPL app could be your first step into the world of credit (on a small, manageable scale). Perhaps you need to buy a laptop for school or a nice suit for job interviews but don’t have the full amount saved – BNPL can help you get it now and pay over a few months. Students often have irregular income (allowances or part-time job money), so spreading out a cost can be a lifesaver. Just be sure you have a plan for paying those installments (maybe from your allowance or side gig). It’s a good way to learn financial responsibility with relatively low stakes, as long as you don’t abuse it. Many BNPL users in PH are in their 20s, showing that Gen Z and young Millennials find these services helpful early in their financial journey.

- Young Professionals on a Budget: Say you’re a young professional in your first or second job. Your salary is decent but not huge, and you’re budgeting carefully for rent, bills, etc. BNPL can be a great tool to manage cash flow. For example, a young professional might use BNPL to buy a working wardrobe (paying for new shoes or clothes in 3 installments aligned with 3 paydays), or to handle an out-of-the-blue expense like a phone repair. If you know you have stable income but just need flexibility in timing, BNPL is your friend. It’s essentially a short-term advance that you know you can cover with your next couple of paychecks. Many people in this group compare BNPL vs credit card and opt for BNPL because they might not qualify for a high credit limit yet, or simply find the app more straightforward.

- Avid Online Shoppers: Do you count down to sales like 9.9, 10.10, 11.11, or add items to your cart regularly on Shopee/Lazada? If yes, BNPL can enhance your shopping experience – responsibly used, of course. Online shopping installments allow you to snag deals when they’re hot. For instance, if there’s a Flash Sale for a high-ticket item you’ve been eyeing but you’ve budgeted that for next month, BNPL bridges that gap. It’s also handy for consolidating multiple items. Maybe you want to buy all your Christmas gifts in one go during a sale, totaling, say, ₱10,000. With BNPL, you could get it all at once and then pay, for example, ₱3,300 a month over the next 3 months. Online shoppers also enjoy the integrated BNPL features of their favorite platforms (like Shopee PayLater or BillEase on Lazada). Just be careful: shopaholics could overextend with BNPL, so this group should use it to augment their purchasing power on planned buys, not as an excuse to buy twice as much stuff.

- Apple Buyers and Gadget Enthusiasts: Gadgets, especially Apple products, are pricey in the Philippines due to taxes and import costs. If you’re someone who loves having the latest iPhone, iPad, or high-end laptop but can’t drop a lump sum, BNPL is a popular route. BNPL for Apple products has grown with official resellers offering installment plans through services like GGives or Home Credit. For example, a freelancer might need a MacBook for work; using BNPL, they can start using it immediately to earn money and let the investment pay off as they pay the installments. Even gamers or techies wanting the newest console or graphics card could use BNPL to afford it without wiping out their savings at once. The key is that these are considered, often necessary or deeply desired, purchases where spreading cost makes sense. Tech enthusiasts who are confident they can meet the payments (perhaps just dividing it across months of salary) should consider BNPL rather than putting it on a credit card with interest.

- Those Without Credit Cards (or with low credit limits): If you don’t have a credit card, BNPL is obviously a fit if you need installment payments. But even if you do have one, some people have very low credit limits on their cards (maybe just ₱10k or ₱20k). That might not be enough for a big purchase like a new furniture set or a medical expense. BNPL can supplement your spending power. It’s also useful for people who deliberately avoid credit cards (some people just don’t like credit cards or are afraid of racking up debt with them). BNPL can be a controlled alternative – you only borrow for specific purchases and have clear end dates for repayment.

- Budget-Conscious Shoppers Making Planned Purchases: If you’re the type who plans out major purchases (like an appliance, a semester’s worth of textbooks, or a home renovation item) and you know exactly what you need, BNPL allows you to execute that plan at the right time. For instance, you find a good deal on a refrigerator, but it’s a bit above what you set aside this month – use BNPL to grab the deal and align the payments with the next couple of months’ budget. This works well if you have the discipline to not misuse BNPL for impulse buys, but rather as a tool for planned spending.

Who might NOT want to use BNPL? If you already have trouble controlling your spending or you’re juggling multiple debts, adding BNPL could be risky. Also, if you have a credit card that you use responsibly and it offers a 0% installment for a purchase you want, sometimes that can be simpler (one less account to manage) – though no harm in exploring both. People who prefer to keep their finances strictly pay-as-you-go (debit or cash only) might avoid BNPL to stick to their philosophy of not buying anything until they have the money in hand.

In essence, BNPL apps are best for those who use them as a convenience, not a crutch. Students, young adults, and regular shoppers in the Philippines are prime users because BNPL fills a gap for them – providing credit where traditional means might not. If you see yourself in one of these groups and have a clear plan to manage installment payments, BNPL could be a very handy addition to your financial toolkit.

Things to Know Before Using BNPL in PH

Before you jump on the BNPL bandwagon, there are important things every user should keep in mind. These tips and warnings will help ensure you use buy now, pay later services wisely and avoid common pitfalls:

- It’s Still Debt – Pay Later Means You MUST Pay Later: This sounds obvious, but it’s worth emphasizing. When you use BNPL, you are taking on debt. Even if it’s interest-free, you owe that money in the near future. Don’t let the excitement of “zero interest” or “no upfront payment” trick you into forgetting that you’ll have to pay it back. Always ask yourself, “Will I be able to pay the installments on time with my future income?” If the answer is uncertain, it’s better to hold off. Responsible usage is key – only use BNPL for amounts you’re confident you can repay comfortably within the timeframe.

- Late Payments Have Consequences: Different BNPL providers have different policies, but almost all will charge a late fee if you miss a due date. For example, if you miss a Shopee PayLater payment, you might incur a fee plus you’ll be blocked from using Shopee PayLater until you settle it. With GCash GGives, missing a payment might lead to a 1% per week penalty on the amount due and it could also lower your GCash trust score (making you ineligible for bigger loans in the future).

If you default for too long, some services will send collection agents or report you to databases that other lenders see. This could hurt your chances of getting any loan (or even another BNPL) later on. In short, late payment risks are real: you’ll pay more money and you could damage your financial reputation. Mark your due dates on a calendar, enable reminders, and as much as possible set up auto-pay if the app allows it (just make sure your account has funds on auto-debit day). - BNPL Might Affect Your Credit or Future Loans: Currently, Philippine credit bureaus are not fully integrated with all BNPL data. But this is evolving. The Bangko Sentral ng Pilipinas (BSP) has been looking at regulating fintech and BNPL platforms more closely. While a timely paid BNPL won’t usually show up positively on your credit report, a seriously delinquent BNPL account might eventually be reported.

Even aside from formal credit scores, if you apply for a bank loan or a credit card, they often ask about your existing obligations. You should disclose if you have ongoing installment debts (even BNPL). If you max out multiple BNPL lines, a bank might consider that you’re overextended. So use BNPL as a helpful tool, but not so much that it jeopardizes your ability to get a more important loan (like for a car or home) down the line. As of now, credit impact is minimal for good BNPL behavior, but could be significant for bad behavior. - Read the Fine Print (Interest, Fees, Terms): Not all BNPL deals are created equal. Before confirming a transaction, check the payment schedule and any fees. The app will show you something like “₱2,000 x 3 months = ₱6,000 total” or it might show “+₱200 service fee” or “with 5% interest per month for 6 months.” Take a second to understand the total cost. If it’s 0% interest, great. If not, calculate what that interest comes out to in pesos and decide if it’s worth it. Also check if there’s any down payment required (some BNPL like BillEase often require an initial down payment at purchase, e.g., 20% of the price, then finance the rest). Make sure you’re comfortable with all those terms. By being informed, you won’t get unpleasant surprises later.

- Keep Track of All Your BNPL Plans: It’s a good habit to maintain a little list or use the app’s dashboard to see all your active installments. Knowing, for example, that you have “3 payments left for Atome, 2 payments left for BillEase, etc.” will help you budget each month. A pro-tip: align your installment due dates with your salary dates if possible. Some apps let you choose or adjust the payment date (or you can time your purchase right after payday so the next ones also fall after payday). For instance, if you get paid on the 15th, maybe schedule BNPL payments on the 16th or 17th of each month, so you always have funds. Best practices for Filipinos using BNPL include: don’t max out all your BNPL limits at once, keep some buffer for emergencies; and avoid using BNPL for very discretionary splurges if you’re already tight on essentials.

- Avoid “Rolling Over” via Other Loans: One bad cycle to avoid is borrowing money to pay off other borrowed money. If you find yourself considering taking a personal loan or using a credit card cash advance to pay your BNPL installments, that’s a red flag that you overcommitted. It’s like paying debt with more debt – usually a sign of financial strain. It’s better to proactively contact the BNPL provider if you’re in trouble; some might allow extensions or adjusted terms if you explain (not guaranteed, but some have hardship extensions). But don’t quietly let things snowball.

- Security and Legitimate Platforms: Make sure you use legitimate, BSP or SEC-regulated BNPL services. The ones mentioned in this article (Atome, BillEase, Shopee, GCash, etc.) are legitimate. Be cautious of any random apps claiming “instant installment” that aren’t well-known – they could be loan sharks or scams. The Securities and Exchange Commission (SEC) in the Philippines regulates lending companies; reputable BNPLs are registered (for example, Atome is registered as Neuroncredit Financing Co., BillEase is by First Digital, etc.). If an offer sounds too good to be true (like extremely long installment with no checks at all), it might be fishy. Stick to known platforms with a good reputation.

- BNPL is Not Savings: Another thing to keep in mind – using BNPL doesn’t mean you saved money; it just means you deferred payment. Don’t mentally treat an item as “cheaper” because you BNPL’d it. Some people might feel like, “Oh I got this ₱5,000 item for only ₱1,250 now!” which could psychologically lead to buying more stuff. Remember the full price still comes out of your pocket over time. Only genuine discounts (like vouchers or sale price) are savings – BNPL just changes when you pay, not how much you pay (except for minor fees/interest differences). So, combine BNPL with actual sales or discounts for smart shopping, but don’t equate BNPL with getting a bargain by itself.

- Plan Purchases – Don’t Impulse Buy Everything: The availability of BNPL on so many apps can be tempting. One second you’re browsing a new TV, the next second it says “Pay ₱1,000/mo for 12 months with 0% interest” and you’re like, “Hmm, that’s doable.” Before you click, step back and evaluate: do I really need or deeply want this item? Is it worth paying for the next X months? Maybe even consider: what if I saved up for it instead – would I still want it by the time I have the full amount? If something is a fleeting desire, don’t turn it into a long-term payment. Use BNPL for things that make sense in your life plan or bring lasting value, not for every shiny new gadget that catches your eye.

- Check if BNPL auto-debits or not: This is a small practical tip. Some services auto-debit (e.g., GGives auto-deducts from GCash, credit cards on file for some BNPLs will auto-charge). Some require you to manually pay (like you have to go into the app and pay via 7-Eleven or GCash each time). Know which is which so you don’t assume an auto-payment went through when it didn’t. If it’s manual, set a reminder a day or two before. If it’s auto, ensure funds are available.

- Use Promotions and Rewards Wisely: Occasionally, BNPL apps have promos – like zero interest even on longer terms for a promo period, or a discount on your first purchase, or referral bonuses. These can be great: for example, if an app gives you ₱200 off your first BNPL purchase, that’s a real saving. Or if an Apple reseller offers 0% for 24 months via a certain BNPL, that’s very compelling (basically free installment for 2 years). Take advantage of such deals if you were already planning to buy something. But avoid being lured into buying something just because there’s a BNPL promo. There will always be another sale or another promo – don’t purchase an item you don’t need simply because “the installment is on promo”.

In a nutshell, educate yourself before using BNPL. It’s a convenient financial innovation, but it requires personal discipline. The Philippine context adds one more layer: many are new to formal credit, so BNPL might be their first taste of borrowing. Make it a positive experience by staying informed and in control. This way, BNPL will remain a helpful tool and not become a source of stress. If you treat every BNPL purchase as a commitment and honor that commitment, you’ll find these services can greatly improve your shopping and budgeting experience.

How to Choose the Best BNPL App for You

Not all BNPL apps are the same, and the “best” one really depends on your needs and lifestyle. Here are some factors and a practical checklist to help you decide which BNPL service in the Philippines is right for you:

- Where Do You Shop Most? Start by identifying your shopping habits. If you’re mostly buying on a specific platform, use the BNPL tailored for it. For example, if you are a heavy Shopee user, Shopee PayLater is an obvious choice to activate. If you love shopping across various online stores or even in malls, a more general BNPL like Atome or BillEase might serve you better as they have multiple partner merchants. For those who frequently buy in person at retail stores (gadgets, fashion, etc.), check out which BNPLs are accepted in those outlets (many stores display stickers for Atome, BillEase, or Home Credit at the entrance). In short, pick an app that aligns with your favorite shops. No point getting a BNPL that you never have the chance to use because your preferred store doesn’t support it.

- Installment Terms and Flexibility: Consider the kind of installment plans each app offers. Do you want the option to pay over longer periods like 6 or 12 months, or are you fine with 3-month plans? GGives and BillEase are known for longer terms up to 12 months (useful for bigger purchases), whereas the basic Atome service is usually 3 months (Atome Card extends to 6). Also, see if they allow you to choose different plans. Some apps might allow both “pay next month” and “pay in 3 months” options (Shopee PayLater does for example), giving flexibility if you just want a short deferment versus a multi-month plan. If you think you’ll need more time to pay for a potential big purchase, go with an app that offers that timeline. On the other hand, if you only ever plan small purchases you can clear in 2-3 months, almost any BNPL will do, so you can prioritize other features.

- Interest Rates and Fees: While many BNPL deals are interest-free, take note of charges for certain scenarios. For instance, does the app charge a processing fee per transaction? (Some charge like 1-5% of the purchase as an admin fee.) What are the interest rates if not 0%? BillEase might charge a monthly interest for 6 or 12 months, GCash GGives interest can vary based on your “GScore” (some pay as low as 0% or 0.5% a month, others up to ~4-5% a month). If you’re very fee-averse, you might stick to apps that guarantee 0% for your typical usage. Atome prides itself on 0% for 3 months at all partners, which is straightforward. Shopee PayLater sometimes adds a small fee, which some users have noted. Also compare late fees – while you don’t plan to be late, it’s good to know (one might be more lenient than another in grace period). Choose the app whose cost structure is favorable to you. If an app is known for sneaky fees or higher interest, lean towards an alternative.

- Spending Limit (Purchase Power): Different apps may grant you different spending limits. If you’re looking to finance a large item, you’ll need a BNPL that can accommodate that price. For example, if you want to buy a ₱30,000 item, an app that only gave you a ₱10k limit won’t work until you build it up. Some people have reported that Atome or BillEase started them at maybe ₱4-6k limit, whereas GCash might give a GGives limit of ₱20k or more if you have a strong GCash profile. Atome Card can provide a high limit (tied to a credit evaluation). If you already have a specific purchase in mind, check the limit you get after signing up for an app – you might have to try another if it’s not enough. Over time, limits can increase with good history, but for immediate needs, it matters. Also, if you foresee using BNPL a lot, an app that grows with you (good credit limit progression) is beneficial.

- App Usability and Customer Support: The user experience matters too. Some apps are more polished and easier to navigate. Since you’ll be checking your schedule and possibly making payments through the app, it helps if the interface is smooth and the instructions are clear. Check reviews or ask friends about their experience. For instance, the GCash app is one many people already use daily, so using GGives feels natural inside it. Atome has a sleek dedicated app that shows all your transactions clearly. On the other hand, some smaller BNPL apps might have glitches or confusing screens. Also consider customer support – if something goes wrong (say a payment didn’t reflect, or you need to adjust something), is there a hotline, chat, or email that’s responsive? Shopee and GCash have large support teams (though not always perfect), whereas a smaller fintech might have slower support. Reliability is key because you’re dealing with payments.

- Reputation and Trust: Since BNPL involves your financial information and obligations, you want a trustworthy provider. The good news is all the big names we’ve discussed are backed by reputable companies. For instance, Shopee PayLater is by SeaMoney (Shopee’s fintech arm), GCash GGives is under Globe and its partner Fuse Lending, Atome is a major BNPL player in Asia, BillEase is a well-funded local fintech. Avoid unknown apps with little information about who runs them. It’s also a plus if the provider is regulated or at least transparent about terms and privacy. Check if people have had major issues – a quick online search can reveal if an app tends to erroneously double charge or has outage issues. You’d want an app that has a stable system (especially if it auto-deducts from your account, you don’t want technical glitches messing up your payments).

- Special Features or Perks: Some BNPL apps offer extra goodies. BillEase, for example, allows you to top-up your prepaid phone load or pay bills with your credit line (essentially letting you BNPL your bills or load). That could be useful if ever in a pinch. Atome has occasional vouchers and promos exclusive to users. GCash GGives might have tie-ups where if you use GGives at a certain store, you get a discount. Check out if any app has features that align with your needs – maybe one offers a longer grace period, or another has a rewards program (though rare in BNPL). Atome Card effectively gives you a more flexible spending method than most BNPL, so that’s a unique feature if you want an all-in-one solution.

- Multiple vs Single BNPL Apps: You don’t necessarily have to pick just one. You can sign up for several and use each where it’s best. But managing many could be confusing. If you’re just starting, maybe try one or two and see how you like them. For example, you could activate Shopee PayLater for your Shopee buys and use BillEase for other online stores. Or use GCash GGives for in-person purchases and Atome for online. Over time, you might gravitate towards one that you find most convenient. Some people might prefer sticking mostly to one app so all their installments are in one place (for simplicity), in which case choose the one that covers most of your shopping scenarios.

In summary, the best BNPL app for you is the one that fits your shopping venues, offers favorable terms for the way you plan to use it, and comes from a provider you trust. It’s a personal choice – someone who never shops on Shopee won’t care about SPayLater, and someone who only needs occasional help on big purchases might go straight for GGives or Atome Card. Evaluate the factors above against your own habits. If possible, read user reviews or talk to friends who have used the apps to get insight on real experiences, like “Does this app have any annoying quirks?”

Remember, you can always adjust: if one BNPL service doesn’t meet your expectations, you can pay off any dues and try another. The goal is to enhance your purchasing power and flexibility with minimal cost and hassle. By choosing wisely, you’ll get the most benefit out of BNPL while keeping your finances under control.

BNPL in the Philippines: Final Thoughts

Buy Now, Pay Later has firmly planted its roots in the Philippine shopping landscape. It’s no longer an obscure fintech experiment – it’s a mainstream payment option that millions of Filipinos have tried and many regularly use. As we’ve discussed, BNPL services in the Philippines have risen in popularity because they address a real need: the desire for installment payment apps in a country where traditional credit is not accessible to everyone. They give ordinary consumers a taste of financial flexibility that was once reserved for credit card holders.

Used correctly, BNPL is a powerful tool for budgeting and convenience. It can help you secure necessities or seize great deals without having to shell out the full amount at once. It levels the playing field in a way – for example, a young professional without a credit card can still buy a laptop in installments to advance their career, or a family can replace a broken appliance immediately and pay over time. In many ways, BNPL has fostered financial inclusion and given people more control over their cash flow. The fact that nearly a third of Filipinos have used these services shows how relevant they’ve become in everyday life.

However, it’s crucial to approach BNPL with the right mindset. Always remember that “buy now, pay later” is not free money – it’s simply a shift in when you pay. The tagline I like to tell others is: BNPL is a bridge, not a gift. It bridges the timing of payment, but you’re still the one paying for the bridge toll eventually. If you walk that bridge with your eyes open (knowing what you owe and when), you’ll get safely to the other side with your finances intact. If you sprint across recklessly grabbing every shiny object along the way, you might find the bridge leads you into a debt pit.

So, as a final piece of advice: use BNPL wisely and sparingly. Leverage it for its strengths – quick, short-term installments on things that matter to you. Avoid turning it into a crutch for overspending. Keep track of your obligations, pay on time (or earlier if possible), and don’t be afraid to say no to a purchase if you realize you don’t truly need it or can’t afford the payments comfortably.

The good news is that with responsible use, BNPL can actually improve your quality of life. Many Filipinos have shared positive experiences like, “I furnished my small apartment via BNPL and it didn’t strain my monthly budget,” or “I used BNPL to enroll in an online course that helped me get a better job – paid the fee in 3 parts while I was studying.” These are success stories where BNPL served as an enabling tool.

Looking ahead, BNPL is likely to continue evolving. We may see tighter regulations (to protect consumers), possibly integration with credit bureaus, and more innovative features. Traditional banks and credit card companies are also reacting – some are lowering their barriers or offering similar pay-later options to stay competitive. All this is to the benefit of us, the consumers, as we’ll have more choices and hopefully better terms.

In closing, Buy Now, Pay Later in the Philippines represents the democratization of installment buying. It puts the power once held by credit cards into the smartphones of everyday people. It’s neither inherently good nor bad – it all boils down to how you use it. If you’ve read this guide, you’re now armed with the knowledge to use BNPL like a pro: you understand what it is, how it works, which apps to consider, and what pitfalls to avoid.

So go ahead and make informed decisions. Whether you’re snagging that must-have gadget or managing an important expense, if you decide to use a BNPL app, you’ll do so with eyes wide open and a plan in hand. Happy (and responsible) shopping – you’ve got this!